So, Do I Need to Pay Taxes in Bali? What You Need To Know as an Expat in Indonesia

As Benjamin Franklin famously said, ‘in this world nothing can be said to be certain, except death and taxes.’ Even if you live in paradise - Franklin’s quote still applies. If you’re a foreigner living and working in Bali, either physically or remotely, here’s what you need to know about taxes.

Foreign nationals who work, run a business, or earn income in Indonesia are required to have a Taxpayer Identification Number (NPWP) as proof of tax compliance.

When Do You Become a Tax Resident?

It’s actually quite straightforward - if you stay in Indonesia for more than 183 days within a 12-month period (around 6 months), you are considered eligible to become a tax resident. At that point, you are expected to obtain a tax identification number (NPWP) in order to comply with Indonesian tax regulations.

Please note that you won’t automatically be issued an NPWP - you must register for it manually. While this process is not yet actively enforced by the Indonesian tax authorities, registering is necessary if you wish to stay compliant with tax laws.

However, it should be noted that you can actually only apply for a personal tax ID if you have a KITAS (a Limited Stay Permit). From a tax perspective, staying in Indonesia for more than 183 days on a tourist or visit visa without fulfilling tax obligations technically constitutes a violation of Indonesian tax law.

From an immigration standpoint, however, it is currently possible to stay in the country on non-KITAS visas for more than 183 days a year without having a tax ID, as the immigration and tax systems are not yet integrated. However, this does not mean it is the correct course of action. To properly comply with Indonesian tax regulations, if you plan to stay in Indonesia for more than 6 months, you should obtain a KITAS that aligns with the purpose of your stay, and register for a tax ID (NPWP) once you exceed the 183-day threshold.

KITAS Types and Tax Implications

The type of visa you have will determine how you pay taxes:

Your employer should automatically deduct personal income tax from your monthly salary.

This means they should manage the tax payments on your behalf, however, it’s advisable to have a discussion to confirm that this will be properly arranged.

You will still need to file an annual tax report by March 31st of each year.

Income must come from your Indonesian investment (dividends, director salary, etc.).

While dividend and salary taxes should be withheld by the company (PT PMA), you may still be required to declare and pay taxes on your Indonesian-sourced income through your annual SPT (tax return).

Even if you don’t make any income from your business, a "0" SPT reporting is still required.

You are required to declare your global assets, but this does not necessarily mean you will be taxed on them. Each situation may differ, so it’s important to consult with your Indonesian accountant for personalized advice.

If you stay longer than 6 months, you’ll need to declare your income through an annual tax report no later than March 31st.

If you don’t stay for 6 months, you should file taxes in your home country or the country that you earn money in.

If you are currently working overseas and not on a Remote Worker KITAS we would recommend switching to one to make sure that you are following the law. The eligibility requirements are listed below:

Passport with at least 6 months validity

Bank statements showing a consistent monthly income of at least US$5,000 over the past 12 months.

Employment contract with a company established outside Indonesia.

CV & Travel Itinerary.

Digital portrait photo.

Requirements for Filing Taxes:

Every NPWP holder should file their taxes no later than March 31st each year:

For first time filers, they should declare their global assets, although no payment is required initially - only the disclosure.

In the following years, you will be required to pay taxes on income earned both in Indonesia and abroad, provided that the overseas income has not already been taxed in its respective country.

Even if you don't owe any tax, you should still submit your annual declaration to avoid potential penalties from Indonesian Tax Authorities.

Foreign nationals with a Taxpayer Identification Number (NPWP) are entitled to tax facilities, such as progressive tax rates and access to tax treaties (agreements to avoid double taxation).

How Much Should I Be Paying?

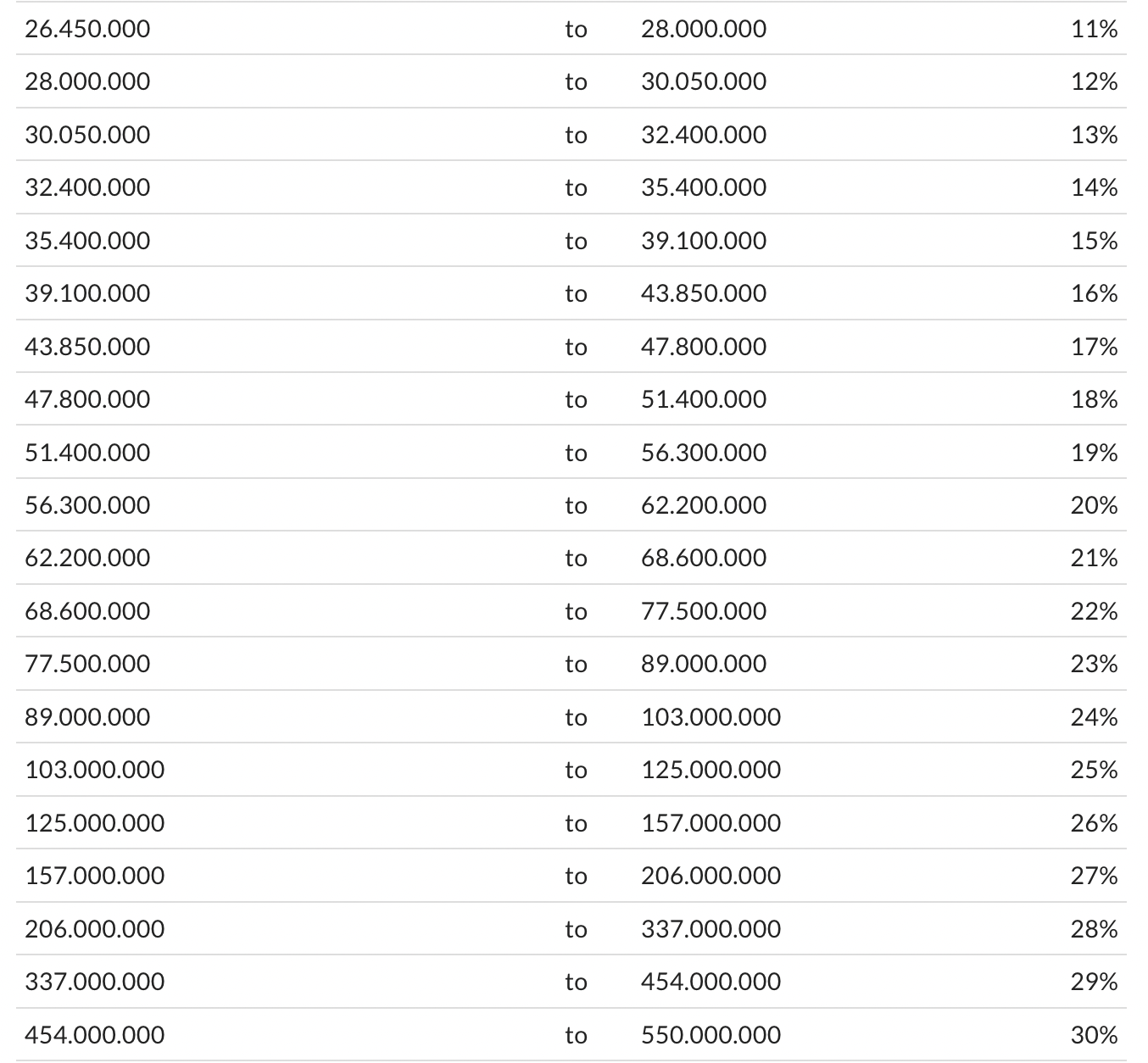

Indonesia uses a progressive tax system, commonly known as “bracket tax”, with rates ranging from 0% to 34% based on monthly income. The government recently updated these brackets in 2023.

The personal income tax rate may vary slightly based on marital status, gender and domestic arrangements, however, the brackets for the most common category - unmarried taxpayers - are as follows:

The Bottom Line

If you stay in Indonesia with your KITAS for over 6 months, you'll need to register for your tax ID (NPWP) and file taxes. It is not automatically assigned when you receive your KITAS, which means you must apply for it separately. Once you have an NPWP, make sure you file your taxes annually.

If you’re confused about your tax situation or are struggling to understand your obligations or how to do the filing process, getting professional help is recommended. It’s better to be proactive to make sure that you don’t end up with any penalties, and know that you’re making the most efficient use of your money with a good tax strategy.

At Bali Solve, we have a team of experts ready to help you with your:

NPWP application and registration

Annual tax return preparation and filing

Tax planning strategies

Accounting

Representation with tax authorities

If you’d like our assistance, simply drop by our Pererenan office today to schedule a consultation or send us a message via Whatsapp. We can assess your situation, help you understand what your obligations are and assist with necessary paperwork, so you can continue enjoying beautiful Bali with peace of mind.

Written by Team Bali Solve

18 May 2025