5 Visa Mistakes That Could Get You in Trouble in Indonesia

Indonesia continues to open its arms to tourists and digital nomads, and it's relatively easy to get a visa to this beautiful archipelago for many international visitors. Whether you fancy walking among Komodo Dragons on Komodo Island, enjoying Bali's unique culture as a digital nomad, or seeing ancient ruins and volcanoes in Java, there's something for everyone.

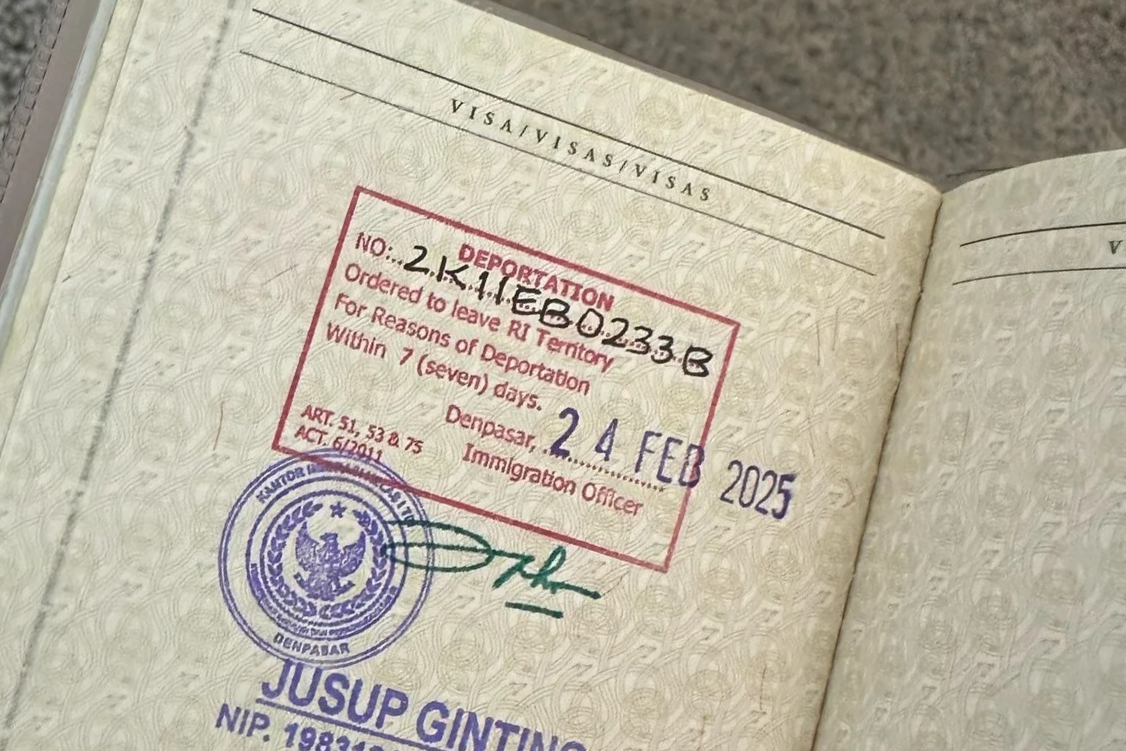

Despite the accessibility, every year many foreigners face fines, legal issues, or even deportation due to visa-related mistakes.

Still, every year, visitors get fined, face legal problems and worse yet, get deported. If you want to avoid being one of them, read our list of visa mistakes that could get you into trouble when in Indonesia.

Mistake 1: Overstaying Your Tourist Visa

One of the most common reasons people have visa issues is overstaying on their visas. When you overstay, it isn't just an administrative hiccup, but a costly mistake. For most, there are fines of IDR 1,000,000 a day. If you stay for far too long (60 days+), you could also face other issues such as:

Detention at immigration facilities

Deportation that you have to pay for yourself

A ban from coming back into Indonesia for periods ranging from 6 months to 5 years

A black mark on your immigration record

In the best case scenario, you will have to pay a fine at the airport before being allowed to exit the country. While it may have slipped your mind or been something you forgot about, claiming you didn't know isn't a valid excuse.

A good way to avoid this is by making sure you set multiple reminders on your calendar, and applying for visa extensions at least a week or two in advance, not at the last minute. Remember that extensions must be processed while your current visa is still valid.

Mistake 2: Working Without The Right Documents

Visitors and long-term foreigners often misunderstand what constitutes 'working' in Indonesia. Some assume that remote work for international companies, performing for a one-off event, teaching English in an informal way, or running an online business isn't really 'working.' However, partaking in such activities has led to problems for many expats and visitors.

In Indonesia, work is often defined very broadly. Any activity that generates money, either in Indonesia or from outside, requires proper work permits or a specific working/digital nomad visa.

While working online for a foreign employer is generally tolerated, promoting services to locals, attending client meetings, or receiving local payments may put you at risk.

All these activities are considered as working in Indonesia:

Remote work for overseas companies while residing in Indonesia (requires a Remote Worker KITAS - E33G visa, not a standard Working KITAS E23)

Freelance consulting or services

Teaching languages, even private tutoring

Creating content for monetized social media accounts

Running any form of business, online or offline

Even posting on Instagram or Facebook about renting rooms, even if you aren't financially benefitting from doing so

If you get caught, you can face consequences such as:

Immediate detention and deportation

Fines up to IDR 500 million (approximately $33,500 USD)

Criminal charges under Indonesian labor law

Permanent ban from Indonesia

Another thing to make note of is the fact you should only do the specific job role that is on your Working KITAS. Unfortunately, you can’t work in several different roles or positions with a Working KITAS. If a visa agent tells you that they can give you a ‘Freelance’ KITAS or offers you the chance to buy a Working KITAS which allows you to, for example, DJ, sing and act, it’s probably not legitimate. The moral of the story is, if you plan on working in Indonesia make sure you do your research, seek trustworthy advice and get the right paperwork.

Mistake 3: Getting Investment Visas for Fake Businesses

Investor KITAS/ITAS is a visa specifically made for those who have a company in Indonesia, and allows you to stay for up to 2 years without renewing your visa. However, in recent years, many foreigners have tried to get one by setting up shell companies or using nominee arrangements, despite not having a genuine business in Indonesia. Whilst in the past this was much easier to get away with, there are currently much stricter laws in place and it's recommended to be careful if you meet visa agents willing to create this arrangement for you.

In recent times, the requirements for those applying for an Investors KITAS has increased significantly. A foreign-owned company is now required to have a substantial capital investment, with each individual shareholder contributing at least IDR 10 billion in personal shares, depending on their role. This is a considerable amount, and if you are found to have a fake business that can't meet the requirements, you may face several consequences. These could include visa cancellation and deportation, criminal fraud charges, permanent blacklisting from Indonesia, as well as hefty financial penalties.

Immigration actively monitors business registrations. Foreigners who set up shell companies only to obtain a visa, without running real operations, risk investigation and deportation.

Indonesian authorities now conduct regular business inspections, require proof of ongoing operations, and cross reference with tax records. Recently, surprise visits to declared business locations are becoming more common.

If you want an Investor visa, it's much better to commit to running a legitimate business with real operations, revenue and Indonesian employees. Consider the investment visa as a means to becoming a legitimate business owner, not just a residency hack.

Mistake 4: Misunderstanding Visa Conversions

When switching from one visa type to another, or extending your visa onshore, don’t assume the process will always be straightforward - in reality, it can often be more complex than expected, as visa regulations in Indonesia tend to change frequently.

As of 2025, there are two possible scenarios to switch from a Visa on Arrival (VOA) to a KITAS:

Exit and Re-Enter – you must leave Indonesia, wait offshore until your KITAS is issued, and then re-enter with the new visa. Your KITAS will officially activate once you arrive and pass Immigration.

Bridging Visa – if you prefer not to fly out, you may be able to apply for a Bridging Visa, which acts as a temporary link between your VOA and KITAS (note that this comes with extra administrative costs).

Switching from Visit Visas to KITAS:

If you are in Bali on a Visit Visa, such as C1, C18, D12, or similar, you may be eligible to switch to a KITAS onshore through the ALTUS mechanism (note: ALTUS onshore visa migration applies only to Visit Visas). However, the ALTUS process generally takes much longer, during which you cannot leave Indonesia, and the administrative fees are higher. By comparison, exiting the country, waiting for your KITAS to be issued offshore, and then re-entering to activate it is usually a faster and more cost-effective option.

If you are planning to change your visa, it’s strongly recommended to consult a visa agent in advance to understand the requirements, avoid surprises, and budget for both time and costs.

Other common challenges include:

With the new bridging system, foreigners holding a VOA can apply for a KITAS without leaving Indonesia.

A 30-day Visa on Arrival can only be extended once for an additional 30 days, giving you a maximum stay of 60 days. If you do not intend to apply for a KITAS through the Bridging Visa mechanism, you must leave Indonesia before your VOA expires.

Working KITAS applications often must be submitted offshore, and in some cases, you may be required to remain outside Indonesia for several weeks while the process is completed.

Improper attempts to convert or extend your visa can lead to rejections, delays, or even overstays. The safest approach is to plan your visa strategy carefully and ahead of time.

Mistake 5: Ignoring Reporting Requirements

Indonesian authorities require foreign residents to report their residence details and any changes in their situation. For instance, if you move to a new address, you are legally obligated to update your KITAS by obtaining a domicile letter (surat domisili) from the banjar in your new area. Immigration reserves the right to conduct random audits to verify that foreigners are residing at their declared address, and failure to update this information may result in significant fines.

In addition, from a tax perspective, if you reside in Indonesia for more than 183 days within a 12-month period, you are technically considered a tax resident. This means you are required to obtain an Indonesian Tax ID (NPWP) and declare your global income to the Indonesian Tax Office. While enforcement of this regulation is relatively weak and many expatriates overlook it, it is important to be aware of the legal requirements.

To make sure you’re compliant, you should let immigration know whenever you change your address and make sure that you understand your tax situation. We would highly recommend getting expert advice if you’re unsure of your tax obligations, as it can save you money and time when compared to doing things yourself.

Need Help With Your Visa For Bali?

Not making these mistakes will give you peace of mind and allow you to stay in Indonesia without any surprises or potentially costly issues. If you need advice or assistance with applying for your visa, learning more about your tax obligations and reporting requirements, or getting the correct permits for your intended stay, simply reach out to us on Whatsapp or drop by the Bali Solve office in Pererenan.

If you’re reading this article because you’ve made one of these mistakes, don’t worry, not all hope is lost! Simply get in touch and let us know what the problem is, and we should be able to assist you in finding a solution. Let’s make your stay peaceful and hassle-free together!

Written by Bali Solve Team

August 27th 2025