Exciting Business Opportunities in Bali for 2026

2026 is just around the corner and with a new year, there are new goals and opportunities. If you’re thinking about opening a business in Bali in 2026, we’ve got you covered. In this article, we’ll explore the most exciting businesses foreigners can open in Bali during 2026 and update you on some of the important regulatory changes that have taken place in the latter half of 2025 which are likely to impact businesses going ahead.

Bali is a highly attractive location for foreign investors looking to establish a business.

Important Regulatory Changes For Businesses in Bali:

In October 2025, Indonesia reduced the minimum capital requirement for foreign owned companies (PT PMAs) from 10 billion IDR to 2.5 billion IDR. This is great news for investors, as opening a business in Indonesia has once again become more accessible.

However, there is a little catch - although you can establish a company with 2.5 billion IDR in capital, the Investor KITAS requirements haven't changed. So if you plan to get an Investor KITAS through your company, you still need a personal shareholding of at least 10 billion IDR as a company director.

You have two options for visas as an investor:

Investor KITAS: requires 10 billion IDR in personal shares as a director. This visa gives you up to 2 years in Indonesia and ultimately works out cheaper than a Working KITAS.

A Working KITAS does not require any minimum share ownership for directors. However, it is typically valid for 1 year, unlike the Investor KITAS which offers 2-year validity. A Working KITAS also carries more stringent corporate compliance obligations, including the requirement for the company to employ at least 10 Indonesian staff before the Working KITAS can be processed.

You can choose which suits you based on how much investment you’re willing to make and your business goals.

Increased Regulatory Enforcement

Whilst it is now more accessible to open a business in Bali, regulatory enforcement has truly stepped up, with more immigration checks, scrutiny over permits and tax audits taking place as time goes on. As such, ‘figuring it out as you go’ is not an option for PT PMA owners - it’s important to have a proper legal structure from the beginning to protect your business and have peace of mind. Make sure you work with a trusted agency when setting up your company, so they can give you sound advice on how to stay compliant.

Greater Scrutiny on Land Zoning

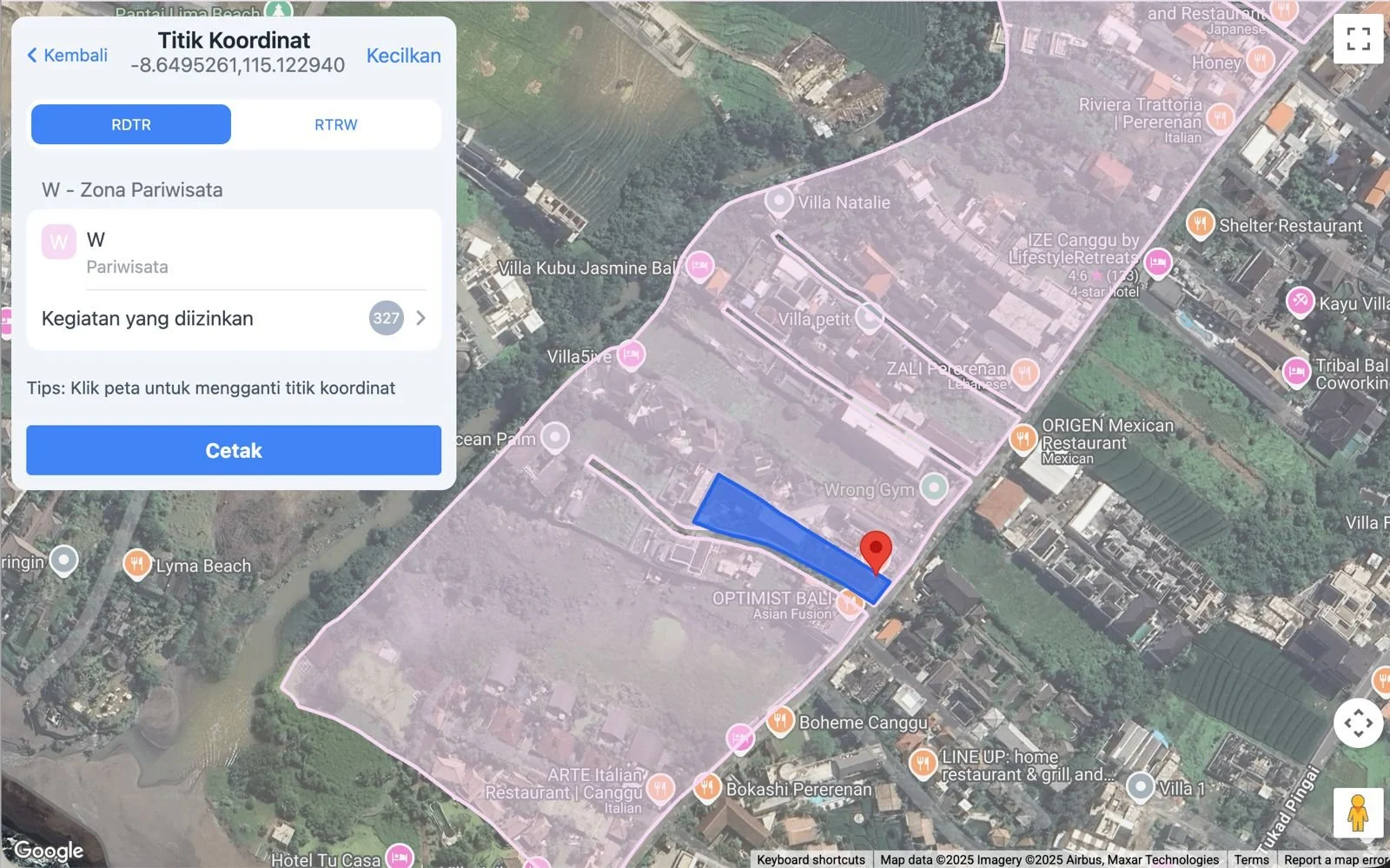

For those interested in property based businesses, it’s important to be compliant and purchase land in the right zone. While in the past many people built rental villas in Green (agricultural) and Yellow Zones (residential areas), this is no longer an option, and said businesses may face issues in the coming years.

Before committing to any commercial land or property rental, ensure that zoning checks are conducted to confirm your business is permitted in that area.

Green zones (conservation, agricultural): absolutely no commercial activity or rentals permitted

Yellow zones (residential): shouldn’t be actively used for Airbnb or short-term rentals

Purple/Pink zones (tourism): suitable for short-term rentals, hotels, and tourism businesses

Orange zones (mixed-use): permits both commercial and residential rental activities, However, zoning variations can exist within mixed-use districts, so each specific land plot must still be double-confirmed through RDTR or local zoning authorities before development or investment.

To ensure your rental business is legally protected, make sure you conduct proper legal due diligence and only build within purple, pink, or orange zones - areas designated for tourism, commercial, or mixed-use purposes. It is also essential to understand how building permit requirements (PBG/SLF) align with the zoning classification of your land before beginning any development.

If you need assistance with property due diligence or guidance on how to invest safely in Bali’s property market, our team is ready to help.

Real Estate Businesses:

Real estate remains an attractive investment sector in Bali, particularly in villa rentals and property development. However, compared to the boom years of the past, returns have generally softened due to rising land prices, increased costs for outsourced services, such as villa management companies, and higher costs of construction materials, combined with a growing volume of competing supply.

The market is somewhat saturated in certain areas, although the price of purchasing property in Bali is still very attractive when compared to Europe. More remote regions of the island, such as North Bali, are increasingly viewed as promising investment areas. With plans underway for a future airport and a larger availability of land, these locations offer attractive long-term potential for investors.

One of the first things to check before leasing a villa long-term is whether it has a valid building permit, commonly known as an SLG or PBG.

Whatever you do, conduct due diligence and work with recommended or trusted professionals. Property complexes that have multiple villas, good management and that are legally compliant are continuing to do well. However, it is important to get into the real estate business with realistic expectations and proper legal foundations, as both the property market and regulatory enforcement have changed in recent years.

Food & Beverage Businesses:

Restaurants: Fully permitted for PMAs without major restrictions. You can establish a foreign-owned restaurant business and operate legally.

Restaurants are great businesses for foreigners, as they are fully permitted, however, the competition is fierce in tourist areas - so do proper market research and try to find a gap that isn’t being served or create a unique offering.

Cafés: Cafés serving primarily non-alcoholic beverages must be 100% locally owned, as foreigners are not permitted to hold café-specific licenses/KBLIs. The legal distinction between a “restaurant” and a “café” is important: if your concept focuses on coffee, tea, and other beverages without substantial food service, it falls under the café category, which requires an Indonesian with full ownership. In this case, foreign investors may need to adjust the concept or structure it as a restaurant to comply with regulations.

Bars: You can open a bar under a PMA structure as long as you obtain the proper alcohol licenses. However, there are several challenges to be aware of. If you’ve ever been out for drinks in Bali, you’ve likely noticed that alcohol is significantly more expensive in Indonesia. This is largely due to high import duties, taxes, and the complex customs procedures required to bring quality alcohol into the country. Partnering with established alcohol suppliers in Indonesia can help streamline this process and reduce operational headaches.

Wellness & Beauty:

Spas: Opening a spa under a PMA structure is possible, provided it is classified as a medical spa. However, certain facility requirements must be met, including employing medical personnel with valid competency certificates and ensuring proper facility management and infrastructure. Authorities are increasingly cracking down on businesses that fail to meet these standards.

Bali has built a global reputation as a wellness destination in the last decade.

Salons: Hair salons, beauty salons and nail salons are not allowed for PMAs. Many businesses operate these services by using spa licenses, but this is actually not fully legal and could expose you to future issues or risks, such as being shut down.

Clinics: IV therapy, injectables (Botox, fillers) and skin booster services are technically permitted. In reality though, opening a clinic is very challenging, as you need to partner with a licensed Indonesian GP and get extensive health permits. Unless you have medical industry connections and a substantial amount of capital, opening a clinic could prove to be quite difficult in Bali in 2026.

Fitness, Retail & Service Businesses

Gyms: This is a more straightforward option as gyms are fully permitted for PMAs. However, make sure you do a lot of market research, as there are plenty of competitive options.

Retail: Clothing and jewelry retail are businesses that you can open without issues as a PT PMA owner. However, shoe retail businesses are only open to locals in Bali.

Something to note is that a single company can’t be a wholesaler and retailer. If you want to operate B2B (wholesale) and B2C (retail) channels, you need to have two separate businesses for this with the correct licenses.

Service-Based Businesses:

Marketing agencies, consulting firms, and similar service-based businesses are relatively straightforward for foreigners to establish in Bali. These sectors are also currently exempt from the 10% local/municipality tax, which primarily applies to tourism-oriented businesses such as villa rentals and restaurants.

If you plan to act as a Director in your business in Indonesia, you are prohibited from engaging directly with customers or performing client-facing work. The Director role is considered a strategic position rather than an operational one under Indonesian regulations.

However, it is important to remember that, as with all PT PMAs, foreigners cannot perform day-to-day operational work themselves. You are required to hire Indonesian employees to handle daily client tasks and operational responsibilities.

Your Next Steps

If you’re thinking about opening a business in Bali in 2026, make sure you:

Choose a business type that’s actually allowed to be owned by a foreigner

Check the zone of your business location and conduct due diligence

Structure your company properly from the start, and get clear on your business goals and visa type

Set aside enough money to be compliant: budget for tax filing, legal support and similar

Build a strong team of Indonesian workers for any task you can’t do yourself

If you stay compliant whilst serving a gap in the market or bringing a good concept to Bali, there’s every chance of making your business successful. Bali is a popular tourist destination with a strong economy and plenty of opportunities for savvy entrepreneurs.

If you need help or advice with anything related to business in Bali, including PT PMA company setup, filing your taxes, accounting or business consulting, we’d love to help you. We can get your business on the right track from day one by ensuring it’s structured properly, and has the right licenses and a good tax strategy, so that you can focus on reaching your business goals. Simply schedule an appointment via Whatsapp to meet one of our handpicked experts at the Bali Solve office in Pererenan. Together, let’s make 2026 be the year you open your business in Bali.

Written by Bali Solve Team

22nd December 2025